From Coins to Core Infrastructure

Institutions are done speculating, they’re building what comes next.

BlackRock’s Bitcoin ETF Outpaces Its S&P 500 Fund—Without Moving the Market (Yet)

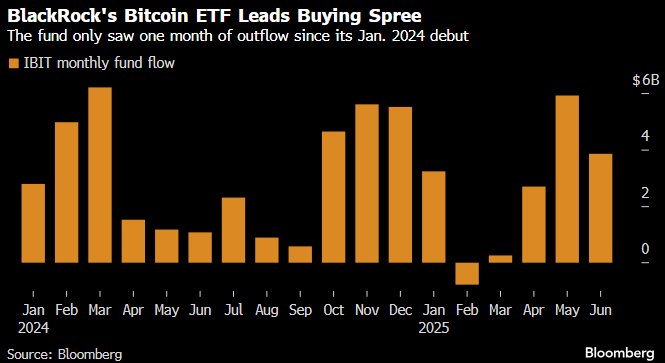

BlackRock’s iShares Bitcoin Trust (IBIT) is now generating more revenue than its flagship S&P 500 ETF (IVV). With $75 billion in AUM and a 0.25% fee, IBIT is generating roughly $187.2 million annually, surpassing IVV, which earns $187.1 million despite managing over $624 billion.

The kicker? IBIT only launched in January 2024. It’s already attracted more than $52 billion of the $54 billion in net Bitcoin ETF inflows. Institutional capital is here, seeking exposure through clean, regulated, and easy-to-onboard products, rather than private keys or hardware wallets.

Yet Bitcoin’s price hasn’t followed suit. That’s partly due to the mechanics: many ETF inflows come from “in-kind” transfers, existing holders moving coins into ETF wrappers without triggering any buying on the open market. At the same time, long-time holders are selling into strength around key levels, such as $110,000, creating temporary resistance.

Still, the trend is unmistakable. As this cohort of sellers thins out and new institutional allocators come off the sidelines, the supply dynamic could flip quickly. For now, we’re witnessing a methodical transfer of coins from early adopters to institutional vaults, a quiet and disciplined form of accumulation.

Robinhood Is Building a Blockchain OS—And So Is Everyone Else

Robinhood just launched Robinhood Chain, a custom Layer-2 built on Arbitrum’s Orbit tech stack. This isn’t just a feature, it’s a statement. Robinhood is moving beyond being a brokerage to become a full-stack financial infrastructure provider.

The rollout begins in Europe, where users will soon be able to access tokenized stocks and ETFs, including high-demand names such as OpenAI and SpaceX. It’s the early blueprint for a 24/7 financial system with global access, self-custody, and composability baked in.

Robinhood isn’t alone here. Kraken is working on a similar product in Europe, quietly building out its marketplace for tokenized equities. Coinbase is headed in the same direction, laying the groundwork with its Base network and recent hires focused on asset tokenization. Each company is approaching from a different angle, but the destination is clear: traditional financial assets, reborn as crypto-native primitives. Exchanges aren’t just listing tokens and letting market makers do the work; they are building out a whole new ecosystem.

a16z Doubles Down on Crypto Infrastructure—and Backs Solana to Help Build It

Andreessen Horowitz has pivoted back to first principles: crypto as the financial substrate of the future.

After years of exploring social apps and crypto gaming, a16z is refocusing on stablecoins, tokenized markets, and settlement infrastructure—all of which have become more viable due to recent improvements in U.S. regulatory clarity.

And they’re not just talking. The firm is a prominent backer of Solana, a chain it once passed on but now sees as ideal for large-scale financial apps. With near-instant, ultra-cheap transactions, Solana is a strong fit for stablecoin networks and tokenized assets, especially if legislation opens the door to new types of issuers beyond just Circle or Tether.

a16z is investing across the lifecycle—from seed rounds to liquid tokens—and its thesis is clear: the next generation of financial infrastructure is being built now.

Closing Thoughts

Crypto’s not about picking one winner. It’s about building across the ecosystem.

BlackRock is cashing in on Bitcoin. Robinhood, Kraken, and Coinbase are creating new rails for trading stocks and assets around the clock, mainly by building on Ethereum. At the same time, a16z is backing Solana, not because it’s “the one,” but because it’s fast, cheap, and useful for different types of apps.

What we’re seeing is a broad push into real infrastructure, not hot air (talking about you, FartCoin). Big players are spreading their bets across multiple chains and platforms to stay flexible and future-proof.

The bottom line? Capital and attention are pouring into crypto, not because it’s a meme, but because the future is finally starting to take shape.

See you next week 😎.